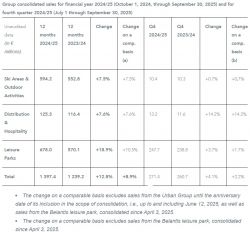

Compagnie des Alpes: Annual sales reach record high of around ?1.4 billionSales for financial year 2024/25 Up +12.8 % on a reported and +8.9% on a comparable basis, with all three Group businesses driving performance In light of this performance, the Group revises its full-year EBITDA growth guidance will be slightly exceeded (from previous guidance of around 15%) Paris, – Compagnie des Alpes reported record sales of €1,397 million for fiscal year 2024/25 (ended September 30, 2025), an increase of 12.8% compared with the previous year. On a comparable basis, sales grew by 8.9%, reflecting strong performances across all three of the Group's divisions, particularly Leisure Parks (growth of 18.9% on a reported and +10.5% on a comparable basis). Commenting on this performance, Dominique Thillaud, Chief Executive Officer of Compagnie des Alpes, stated: “Financial year 2024/25 marks another record year for Compagnie des Alpes. Our mountain operations posted significant growth for the third consecutive year, and nearly all of our leisure parks reached or surpassed record attendance levels — notably with 2.5 million visitors at Futuroscope and nearly 3 million at Parc Astérix. Compagnie des Alpes has also successfully optimized its operating costs throughout the financial year and, thanks to the commitment of all its teams, adapted effectively to slightly less favorable conditions in the leisure parks during the fourth quarter. As a result, we are pleased to estimate that our FY 2024/25 EBITDA growth guidance will be slightly higher.” During the fourth quarter of the financial year (July 1 through September 30, 2025) alone, Compagnie des Alpes generated sales of €271 million, up 4.1% compared with the same period one year earlier. On a comparable basis, sales grew by 2.2%, mainly reflecting slower sales growth at two parks over the summer due to extended periods of unfavorable weather (34 out of 62 days in July and August), which had a particularly adverse impact on Walibi Rhône Alpes and Parc Astérix, and the postponed opening of a highly anticipated attraction at Parc Astérix. Despite this challenge, Parc Astérix nevertheless broke its attendance record for the financial year and achieved another increase in per-visitor spending. Ski Areas & Outdoor Activities: another record year Sales for the Ski Areas & Outdoor Activities division rose to €594 million for the full 2024/25 financial year, representing an increase of 7.5% compared with the previous financial year. Ski lift business (more than 95% of the division's sales) grew by 7.6%, thanks to an increase of approximately 6.6% in average revenue per skier-day and a 1.0% increase in the number of skier-days. The latter reached 13.9 million units, surpassing last year's previous record of 13.8 million skier-days. Once again, Compagnie des Alpes successfully capitalized this season on the public's enthusiasm for winter sports and mountain getaways, leveraging both the natural appeal of its high-altitude ski areas and its ongoing investments in modernizing facilities and redesigning slopes to optimize skier flow. This year, capital expenditures focused primarily on the Les Arcs, Val d'Isère, and Tignes ski areas. During the fourth quarter alone, the division's sales — which account for less than 2% of annual activity — reached €10 million, up 0.7% compared with Q4 2023/24. This performance was driven by a solid contribution from Evolution 2 and the success of its portfolio of summer mountain outdoor activities. Distribution & Hospitality: continued robust growth in accommodation Sales for the Distribution & Hospitality division amounted to €125 million for financial year 2024/25, up 7.6% compared with the previous financial year, with an uptick in the last quarter. Fourth-quarter sales, which account for just over 10% of annual business, reached €13 million, up 14.2% compared with the fourth quarter of 2023/24. This strong performance was driven primarily by MMV, which contributes the bulk of the division's sales during the summer season. Over the year as a whole, MMV enjoyed particularly strong sales, boosted by satisfactory occupancy rates and an increase in average revenue per night. This strong performance reflects successful optimization of the opening schedule and the upmarket positioning of some of its residences. MMV also benefited from sales generated by the agreement to market the Terrésens hotel residences, in which Compagnie des Alpes acquired an initial 33% stake. In the fourth quarter, MMV's performance was further boosted by the opening of the Village Club at Alpe d'Huez, which was closed throughout the summer of 2024. Mountain Collection Immobilier, the leading real estate agency network in the Alps, delivered a strong performance over the financial year. The network benefited from expanded operations, with the opening of a new branch, an increase in the number of properties available for sale, and the recovery of its real estate transaction activity. Finally, as anticipated, Travelfactory's sales were stable compared with the previous financial year, reflecting the Group's strategy of prioritizing margins over volumes. Leisure Parks: double digit organic growth Sales for the Leisure Parks division reached €678 million for financial year 2024/25, compared with €570 million the previous financial year, up by 18.9% on a reported basis, including the Urban Group over 12 months (compared with 3 months and 18 days in 2023/24), and including the first six months with Compagnie des Alpes of the Belantis leisure park, acquired on April 3, 2025. On a comparable basis, the division's sales grew by 10.5%. This strong performance was primarily driven by higher ticketing sales and in-park spending (which together account for more than 85% of the division's total sales). This growth reflects a 9.3% increase in attendance and a 2.3% rise in average spending per visitor. The Leisure Parks business was once again very dynamic this year. The Halloween and Christmas periods were successful thanks to efforts to enhance the parks' themes, organize events, and extend opening hours. Business was also particularly strong in the spring, before slowing in the fourth quarter, primarily due to the delay (caused by the builder) in opening the new Cétautomatix attraction at Parc Astérix. Initially scheduled to open in April, the attraction instead began operating after August 15. Poor weather conditions (heat waves over a significant number of consecutive days and violent storms) also adversely impacted sales, in particular for Parc Astérix and Walibi Rhône Alpes. Sales for the fourth quarter amounted to €248 million, up 3.7% on a reported and 1.7% on a comparable basis (excluding the Belantis park) versus the fourth quarter of 2023/24. Overall, nearly 80% of site visitors reported being satisfied or very satisfied with the value for money of their visit—an indicator that has further improved this year. The Group reiterates that it actively manages park attendance levels to align with capacity, with the goal of maintaining a remarkably high level of visitor satisfaction, even during peak periods, particularly in the summer season. The strong sales performance in financial year 2024/25 was once again supported by strategic investments aimed at enhancing attractiveness. For example, Futuroscope benefited from the launch of its new Mission Bermudes attraction and from the success of Aquascope — a water park inaugurated in July 2024 within the Futuroscope complex and operating with its own ticketing system — which further strengthens the park's overall appeal and encourages longer visitor stays. As a result, Futuroscope exceeded 2.5 million visitors this year. Walibi Belgium also delivered a strong performance, driven by its 50th anniversary celebrations, the redevelopment of the Dock World area, and the launch of a new attraction, Mecalodon. Other sites, including Musée Grévin, Aqualibi, Bellewaerde, and Walibi Holland, likewise reported significant growth over the period. The Urban Group also reported significant sales growth for financial year 2024/25 compared with the previous year, driven primarily by the ramp-up of the Île de Puteaux sports complex and the opening of three new centers during the year. Outlook Guidance on the Group's 2024/25 EBITDA Given the strong business momentum across all three divisions and the effective management of operating expenses during the year, the Group confirms that its target of approximately 15%[1] EBITDA growth for financial year 2024/25 will be slightly exceeded. Business activity year-to-date, since the close of the financial year In the mountain resorts, current booking trends for accommodation for the upcoming season — particularly for the Christmas holidays — are showing positive momentum. As for the Leisure Parks division, the Halloween season underway is off to a strong start. Likewise, the upcoming Christmas period is shaping up well, with advance ticket sales running ahead of last year — particularly in the B2B segment (corporate events). Q4 Highlights La Compagnie des Alpes won the public service concession (DSP) for the Pralognan-la-Vanoise ski area and renewed one of the DSPs for the Flaine ski area. On July 15, Compagnie des Alpes announced that its bid had been selected by the municipal council of Pralognan-la-Vanoise (Savoie) for the public service concession contract covering the development and operation of its mountain area (alpine ski area, Nordic ski area, and central reservation system). This marks a new public service concession for the Compagnie des Alpes, with the 25-year contract set to take effect on November 1, 2025. In the Grand Massif ski area, Compagnie des Alpes also renewed an agreement with the Haute-Savoie Department for one of the ski area concession contracts in Flaine, extending it for a period of 3 years and 7 months. According to the Group's estimates, the cumulative sales over the term of these new contracts/renewals contribute approximately €310 million to Compagnie des Alpes' backlog.[2] Exclusive negotiations for the potential sale of the Chaplin's World site to Compagnie Chargeurs Invest Compagnie des Alpes entered into exclusive negotiations with Compagnie Chargeurs Invest aimed at selling the Chaplin's World site in Switzerland. If these negotiations are successful, the transaction will remain subject to the usual prior authorizations and approvals, as well as certain customary conditions precedent. In 2024/25, Chaplin'World's sales amounted to approximately €5 million. International industry recognition for Compagnie des Alpes' parks On August 27, 2025, Compagnie des Alpes and its flagship parks shone at the 2025 Park World Excellence Awards, reaffirming the Group's commitment to pushing the boundaries of innovation and delivering truly unique guest experiences. Industry professionals once again recognized the quality, originality, and creativity of the Group's investments. The new Les Fastes du Nil restaurant at Parc Astérix received the award for “Best New Food Experience.” At Futuroscope, the Mission Bermudes attraction won two awards — “Best New Attraction” and “Best Innovation.” Walibi Rhône-Alpes was named Best Regional Park, while YOY at Walibi Holland earned the title of “Best New Rollercoaster,” and Amazonia at Bellewaerde was recognized as the “Best New Attraction.” Finally, Walibi Belgium received the “Best Use of Theming” award for the redevelopment of its Dock World area. Launch of an overnight train service between Paris and Bourg-Saint-Maurice Travelski, a subsidiary of Compagnie des Alpes, has launched bookings for a new overnight train service, the Travelski Night Express, between Paris and Bourg-Saint-Maurice for the 2025/26 winter season. This mobility solution for travelers heading to the French Alps is fully aligned with Compagnie des Alpes' raison d'être and its commitment to implementing initiatives that reduce its Scope 3 (indirect) carbon emissions. The night train service will operate 14 round trips between December 19, 2025, and March 20, 2026. (Partez en train de nuit vers la montagne avec Travelski Night Express) Post-Closing Event on September 30, 2025 Compagnie des Alpes announces a €250 million investment plan for Parc Astérix On October 18, Parc Astérix announced its ambition to join the Top 5 European leisure parks to 2030, through a major €250 million investment plan extending (of which nearly 35% in the form of financial leasing – amount to be checked for hotel + train attraction), including a fourth hotel with 300 rooms scheduled for 2027, as well as five new attractions and new food & retail outlets. The plan notably includes Cétautomatix, a family roller coaster themed around the famous blacksmith, and Les Fastes du Nil, a new restaurant within the Egypt zone — both inaugurated this year. This plan — the most ambitious in the park's history — aims both to expand the park's offerings and to renovate existing assets. Starting in 2026, the Egypt area will be expanded and fully re-themed, including its existing attractions and restaurant. In 2027, the park will open a fourth hotel with 300 rooms, bringing total on-site capacity to 750 rooms, along with a conference center for up to 800 guests. Also in 2027, two new attractions will be added to the Greek area. Then, in 2028, Parc Astérix will inaugurate the entirely new Londinium zone — a fully indoor area featuring two attractions (including a roller coaster), a playground, a pub, and several shops. By 2030, the Group aims to increase the total capacity of Parc Astérix by 20%, two-thirds of these 20% will be indoors, reducing dependence on weather conditions. The equivalent of 900 full-time jobs will also be created, adding to the park's current workforce of 1,500. This press release contains forward-looking statements concerning the outlook and growth strategies of Compagnie des Alpes and its subsidiaries (the “Group”). These elements include indications relating to the Group's intentions, its strategies, its growth outlook, and trends concerning its operating results, its financial situation, and its cash position. Although these indications are based on data, assumptions, and estimates that the Group considers to be reasonable, they are subject to numerous risk factors and uncertainties such that actual results may differ from those anticipated or implied by these indications due to multiple factors, in particular those described in the documents registered with the Autorité des marchés financiers (AMF) available on the Compagnie des Alpes website (www.compagniedesalpes.com). The forward-looking information contained in this press release reflects the guidance given by the Group on the date of this document. Unless there is a legal obligation, the Group expressly de |

ropeways.net | Home | Economy | 2025-11-06

More articles:

Pacific Group Resorts: Ragged Mountain Resort sold

2025-11-13

Midwest Family Ski Resorts Commits $12M in Major Upgrades

2025-11-12

Tamarack Resort Announces Mountain and Resort Enhancements

2025-11-11

Google Adsense

Back

Back Add Photos

Add Photos Print

Print