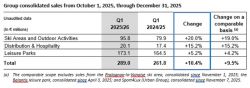

Compagnie des Alpes: 1st quarter 2025-2026 SalesCompagnie des Alpes reported its consolidated sales for the first quarter of financial year 2025/26. Sales amounted to €289.0 million, up 10.4% compared with the first quarter of financial year 2024/25. On a comparable basis, excluding the contributions from the Pralognan-la-Vanoise ski area, the Belantis leisure park, and the Sport4Lux sports center, sales grew by 9.5%.

Sales for the first quarter of 2025/26, however, were boosted by an extra day of Christmas vacation compared with last year[1], with a particularly noticeable impact on the growth of mountain operations. Measuring performance up to the end of the school vacation to neutralize this favorable calendar effect, sales growth for the Ski Areas and Outdoor Activities segment remains strong (around 7%). For Dominique Thillaud, CEO of Compagnie des Alpes: “This start to the financial year, in line with our expectations, is extremely encouraging. It confirms sustained demand for skiing during the year-end vacation period and also highlights the potential of the Christmas season for the Leisure Parks segment, which could ultimately become as significant a contributor to sales as the Halloween period. Last but not least, I am pleased with the relaunch of the Paris–Bourg-Saint-Maurice overnight train service, which provides low-carbon transportation access to many resorts in the Tarentaise valley. ” Ski Areas and Outdoor Activities: a very good start to the season Sales for the Ski Areas and Outdoor Activities division reached €95.8 million in the first quarter of 2025/26, an increase of 20.0% on a reported basis (including the Pralognan-la-Vanoise ski area, operated by Compagnie des Alpes since November 1, 2025) and 19.0% on a comparable basis, compared with the first quarter of 2024/25. Sales growth is partly due to a favorable calendar effect, as the first quarter had one additional Christmas vacation day than last year. Measured from October 1, 2025, to January 2, 2026 [2], to neutralize this effect, ski lift business grew by approximately 7% on a comparable basis compared with the same period last year. Approximately one-third of this growth was due to an increase in the number of skier-days and approximately two-thirds to an increase in average revenue per skier-day. The strong performance reported by the ski areas reflects an exceptional early season, supported by very favorable weather conditions (abundant snowfall and cold temperatures), which translated into an excellent start for the 2025/26 winter season, with some resorts even opening ahead of schedule. The Christmas holiday period also saw robust activity, confirming the strong appeal of winter sports in high-altitude resorts. This season, the Compagnie des Alpes' ski areas boast several new ski lifts, thanks to the Group's modernization investments:

Distribution & hospitality: strong momentum across all components Sales for the Distribution & Hospitality division also saw significant growth, rising to €20.1 million, up 15.2% compared with the first quarter of financial year 2025/26. Benefiting from the same favorable drivers as the ski areas, each of the three components of the division, MMV for accommodation, Mountain Collection Immobilier for real estate agencies, and Travelfactory for tour operator activities, recorded strong growth compared with the first quarter of financial year 2024/25. Since December 20, 2025, MMV has benefited from the opening of a new Club Residence, Le Serra Neva, in Serre Chevalier. With a capacity of 1,020 beds, this residence offers modern apartments in the heart of the resort in both winter and summer. It is equipped with a swimming pool, a wellness area, and a kids' club. This brings the number of Club Residences and Club Villages operated under the MMV brand to 22. Travelfactory has begun operating its night train service between Paris and Bourg-Saint-Maurice. With one round trip per week (departing Paris on Friday evening and returning to Paris on Sunday morning), the Travelski Night Express will make a total of 14 round trips this season, one last return trip from Bourg-Saint-Maurice on 28 March. The night train has 660 berths and a bar-restaurant car. This service offers skiers a carbon-free, safe, and convenient transportation solution that allows them to maximize their time at the resort. To date, reservations are in line with Group expectations. Leisure Parks: continued business growth following last year's record performance Sales from leisure parks reached €173.1 million in the first quarter of 2025/26, an increase of 5.2% compared with the first quarter of 2024/25. On a comparable basis, i.e., excluding the contributions of Belantis and Sport4Lux, sales grew 4.2% compared with the same period last year, which was a particularly high basis for comparison. Growth was primarily driven by an increase in spending per visitor. This year once again, the vast majority of sites successfully delivered immersive experiences to visitors, theming their entire spaces first for Halloween and then for Christmas. They also intensified their efforts and innovation to offer a wide array of notable new features. Activity during the Halloween period alone increased compared with the record-setting previous year. The trend confirms an ongoing move upmarket, with more themed zones, specially created shows, new haunted houses, and additional nighttime events, such as Astérix hosting three extra evening sessions this year. During the Christmas period, business growth was even more pronounced, reflecting the Group's strategy of expanding its offering during this season. This performance was notably supported by strong performances for Parc Astérix, Bellewaerde, and Walibi Belgium, driven by targeted attractions such as light displays, ice rinks, shows, and Christmas markets, which successfully stimulated visitor interest. For example, following a successful “Fright at the Park” event, Parc Astérix recorded over 10% growth in sales during its “Gaulish Christmas,” while Walibi Belgium experienced a more than 25% increase in business over the Christmas period. Christmas is therefore becoming an established part of visitor attendance patterns and represents significant future growth potential. In the first quarter of the financial year, the Urban Group experienced dynamic sales, boosted by the ramp-up of the Île de Puteaux center, the opening of new centers in Avignon and in Marseille, as well as the acquisition of Luxembourg's leading five-a-side football and padel center, which, due to its size, ranks among Urban's top three centers. Outlook for the year ahead This outlook is subject to major economic contingencies. The strong performance recorded in the first quarter of 2025/26 enables Compagnie des Alpes to confirm its target of achieving close to 10% growth in EBITDA, excluding capital gains related to proceeds from the disposal of fixed assets in Tignes, for the full financial year. The Group notes that the positive calendar effect from an additional Christmas vacation day observed in the first quarter will naturally be offset in the second quarter. The strong booking levels for the Alpine resorts, including MMV, give the Group confidence for the remainder of the season, particularly for the February school holidays. However, sales could be impacted by the late timing of the spring school holidays in Zone C in France (Paris, Montpellier, Toulouse), which is scheduled for April 18 to May 4. For leisure parks, after a good first quarter, this spring, their appeal will be boosted by the following new developments:

|

ropeways.net | Home | Economy | 2026-02-03

More articles:

Axess: Over 20 years elevating guest experience at SkiStar

2026-02-12

Google Adsense

Back

Back Add Photos

Add Photos Print

Print