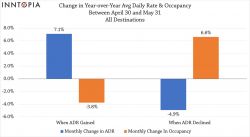

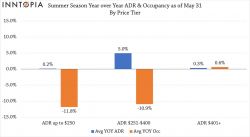

Daily rates finally softening in Mountain Destinations; occupancy nudging upJune 13, 2023 - With exceptional snowfall the not-so-secret weapon for driving high occupancy and daily rates throughout the winter - and now melted away until next season, lodging properties at western mountain destinations are facing the summer season with a somewhat different, and more price-sensitive customer than encountered over the winter. The consistently rising rates of the past 25 months have slowed considerably in recent months according to the most recent monthly Market Briefing released by DestiMetrics,* part of the Business Intelligence division of Inntopia. Data collected through May 31 from 17 mountain destinations in seven states revealed that summer occupancy has been down considerable for the past few months for the first time since the early months of the pandemic. However, softening room rates offered during May at some properties is starting to fill in some of the occupancy deficits for the upcoming season although aggregated summer occupancy still remains well below last year’s record level. The Market Briefing offers both a single year-over-year comparison alongside a comparison to the last full pre-pandemic summer of 2019. The Briefing omits comparisons to the summers of 2020 and 2021 due to the dramatic anomalies in the data caused by the pandemic. May was okay Actual occupancy in May was down 1.4 percent in a year-over- year comparison while the Average Daily Rate (ADR) was up a slight 2.1 percent and the result was a scant 0.7 percent increase in revenue. When compared to four years ago at this time, occupancy for the month was down a sharp 15.2 percent but buffered by an ADR that was up a very strong 35.6 percent, revenues were up a healthy 14.9 percent compared to four years ago. Comparing to the same time four years ago—the last summer before the pandemic hit—occupancy is down 15.2 percent while the daily rates are much higher than the summer of 2019 and are up a dramatic 35.6 percent to deliver a revenue increase of 14.9 percent. Summer occupancy gradually edging up; rates softening A review of the full summer as of May 31 shows that on-the-books occupancy for May through October is down five percent compared to last summer with declines in all months except October which is showing a 2.9 percent uptick in occupancy. ADR for the summer has eased back from its previously strong upward trajectory and is up only a slight 0.9 percent with tiny gains in all months except August and September which are down slightly. June is showing the most notable gain—up 7.6 percent. The contrast with four years ago is striking, especially rates. Occupancy for the full six months of summer as of May 31 is down 8.4 percent with notable declines in all six months. In contrast, ADR is up a dramatic 41.9 percent compared to Summer 2019 and those robust daily rates are amply offsetting the lower occupancy to achieve a 30.1 percent increase in revenue. “The long-term impact of inflation and high prices has been producing softer bookings and shorter stays for some time. With the winter incentive of snow no longer a lure, those forces are more pronounced heading into summer,” explained Tom Foley, senior vice president of Business Intelligence for Inntopia. “And when you consider that summer visitors to the mountains are generally more economically diverse and rate-sensitive, those changing business conditions require a shift in pricing and marketing strategies.” Foley further reported that “in the past month, we have seen lodging properties responding to booking reticence by bringing year-over-year rate growth down to an essentially flat level compared to last summer. And, consumers have responded and we are seeing both occupancy and revenue improving appreciably from last month although both remain below last year.” Economic Indicators In a reversal from the previous two months, the Dow Jones Industrial Average (DJIA) dropped more than 1,189 points at the end of May for a 3.49 percent decline in the Index compared to the end of April. This is the third time in the past six months that the Dow has posted an end-of-month decline compared to the previous month and signals that both consumers and investors remain wary about the direction of the economy. Dragging the market down were the debate and uncertainty about raising the debt ceiling and the ongoing high cost of living with consumer prices edging up 0.4 percent in May—despite the national inflation rate down to 4.9 percent. Compared to last May, the DJIA was only down a slight 0.2 percent from May 2022. Consumers continue to indicate concern about the economy as both the Consumer Confidence Index (CCI) and the Consumer Sentiment Index (CSI) declined during May with consumers expressing increased concern about the employment market while opinions about inflation were relatively unchanged. The CCI slipped from 103.7 in April to 102.3 in May with decreases being recorded at all income levels. And after an uptick during April, the University of Michigan’s CSI gave up 4.2 points during May to settle at 59.2. “Both indexes reported declines across all income levels but primarily in the mid-range,” explained Foley. “The fact that there was little movement about inflation concerns suggests that consumers have made long-term adjustments to their spending habits in anticipation of the cost of living remaining high for the foreseeable future.” The national Unemployment Rate rose 0.3 points during May to finish at 3.7 percent. Employers added a stronger than expected 339,000 new positions with the biggest gains in the Professional and Business Services sector while Leisure & Hospitality added 48,000 with a large portion of those jobs—33,000—in the Food & Beverage sub-sector and the other 15,000 in Accommodations. Although continuing to recover from the pandemic, it is the only major sector still lagging behind pre-pandemic levels—down 3.4 percent. The national inflation rate decreased to four percent from 4.9 percent in May, while consumer prices went up a slight 0.1 percent during the month and below the 2023 average of 0.35 percent. “Usually these ongoing surges in job creation indicate that the economy is still too hot, counter to the Federal Reserve Bank’s goals of slowing things down, which they do by raising interest rates,” offered Foley. “And while this month’s job report suggests the Fed should consider putting further rate hikes in place, Tuesday’s good news on inflation provides them with a strong counter-argument to doing so,” he continued. “If the Fed opts to hold off on further interest rate hikes for now, that will be welcome news for travelers planning to use credit cards to finance upcoming trips.” Grappling with daily rates Fewer bookings and shorter stays for this summer are clear evidence that consumers are showing fatigue with persistently high daily rates that have been climbing steadily for more than two years. But the Market Briefing outlined some disparities in how different groups are responding to rates. In destinations where year-over-year rates rose, gaining an average of 7.1 percentage points during May, occupancy dropped by 3.8 percentage points. But properties were rates dipped, declining an average of 4.9 percentage points, there was a strong 6.6 percentage point improvement in summer occupancy. “Overall, lodging properties have pulled back sharply on raising their ADR in the past 90 days in an effort to drive higher occupancy and improve revenue,” explained Foley. “This strategy has worked with some, but not all customers and summer occupancy and revenues remain negative.” As further evidence that cooling down rates is working to attract visitors, Foley points out that at the end of February, summer ADR was up 7.9 percent but on-the-books occupancy was down a sharp 14.2 percent compared to last year. March aggregated rates came down a modest 1.4 percentage points to nudge occupancy up a tiny 0.6 percent. But in April, when properties lowered ADR a further 3.6 percentage points, it captured consumer interest—leading to a 3.1 percent improvement in room nights booked for the summer. In May, another drop of 1.9 percentage points in ADR triggered another 4.4 percent increase in room nights booked. “Essentially, in the last 90 days, rates have softened seven percentage points which has led to an 8.1 percent improvement in demand,” Foley clarified. “Consumers are definitely responding to the easing rates.” The Briefing also reported variations among the three pricing categories studied. Properties with an ADR of up to $250/night are currently eking out a slight 0.2 percent gain in ADR but wrestling with an 11.8 percent decline in occupancy among this most price-sensitive consumer. Properties with an ADR between $251 and $400 are charging five percent more for summer bookings this year but are seeing occupancy that is currently down 10.9 percent. Guests booking the most expensive tier of lodging with and ADR over $401/night (21 percent of the sample) appear to be the least affected by rate increases and these properties are seeing an increase in summer occupancy. “It seems intuitive, but having the data confirm that the budget-conscious travelers is looking for some rate relief is both a valuable message, and tool, for lodging managers. However, whether those more moderately priced properties have enough margin to lower rates geared to their target audience is less certain,” offered Foley. “The slower booking pace and lower occupancy have sparked properties into taking action and we’re seeing those record-high rates beginning to retreat and consumers are responding positively to the softening rates,” he continued. “That said, what we are seeing is that almost everywhere rates are up, demand is weakening and conversely, the properties where rates are dipping, demand is rising.” Foley was quick to point out though that “conditions are better now than they were just 30 days ago and much better than three months ago as we see that booking pace is up—even though length-of-stay is down.” He summarized the current situation by confirming that “the reality is, mixed economic conditions and broadening competition from cruise and urban travel is increasing the challenge for mountain destinations--and lodging properties are now grappling with something we’ve been expecting for more than 18 months—a correction in the massive growth of rates,” he concluded. DestiMetrics DestiMetrics, part of the Business Intelligence platform for Stowe-based Inntopia, tracks lodging performance in resort destinations. Each month, the forward-looking reservation data is compiled and aggregated with individualized results for each region and distributed monthly to subscribers at participating resorts. Approximately 28,000 lodging units in 17 mountain destination communities across Colorado, Utah, California, Nevada, Wyoming, Montana, and Idaho contribute to the data pool, and represent an aggregated 55 percent of all available rental units in those regions. Results may vary significantly among/between resorts and participating properties.

|

ropeways.net | Home | Tourism | 2023-06-21

More articles:

Utah’s ski industry contributed $1.94 billion in nonresident visitor spending

2024-05-10

Vail Resorts Named by Newsweek as One of the Most Trustworthy Companies in America

2024-05-09

Sunkid: A colorful surface lift project by Star Lifts USA Inc.

2024-05-08

Google Adsense

Back

Back Add Photos

Add Photos Print

Print